How to Create a Budget for Your Online Business (In 3 Steps)

Contents

Every business starts with an idea. However, running a company takes more than a great idea and a creative vision – you'll also need funds.

Creating a budget for your business can ensure you have enough money to cover your expenses and maybe even turn a profit. As your company continues to grow, this document can become a roadmap for your financial success.

In this post, we'll discuss why every online business needs a budget. We'll then show you how to create a long-term plan covering everything from meeting your essential bills to expanding your company. Let's get started!

What is a Business Budget (and Why It's Important to Have One)

According to the Bureau of Labor, two out of ten new businesses fail within the first year. Many factors contribute to a company closing its doors. However, a study of over 80 failed startups discovered that 50% of the founders didn't have clear budgets.

A budget is a financial plan that estimates your online business's revenue, capital, and expenditure over a period of time. When creating a budget, you'll carefully plan where you spend your money. Doing this ensures there's a legitimate reason for every expenditure:

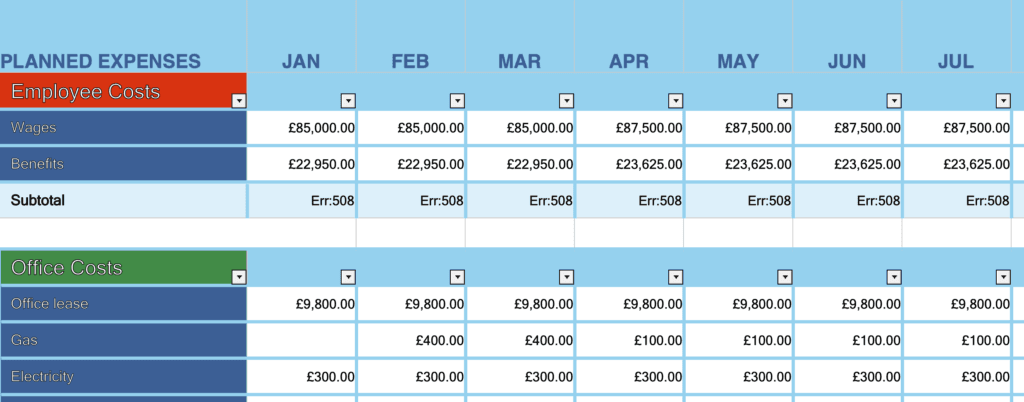

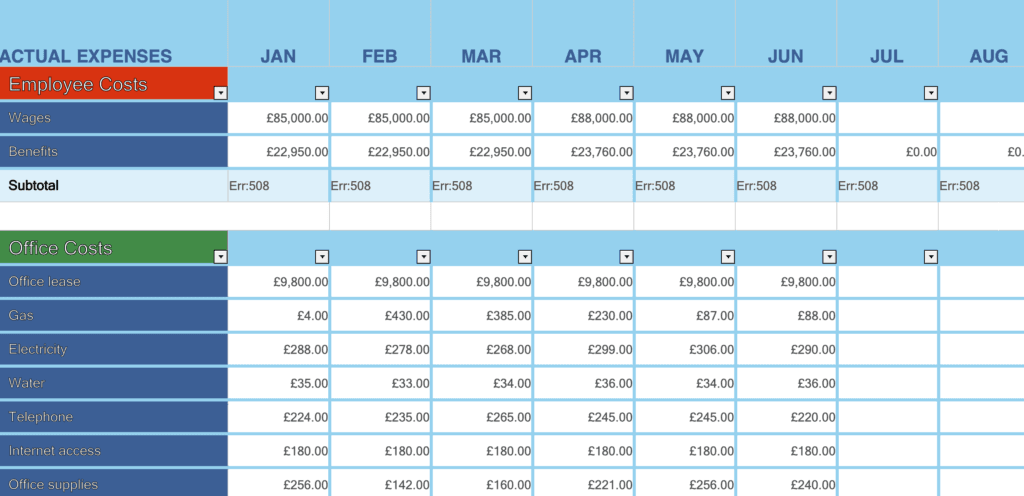

A budget can also hold you accountable by comparing your plan to your spending reality. As such, it can help you avoid overspending:

As part of your financial planning, you'll forecast the amount of money you'll earn in the form of revenue, sales, and profit. These predictions can help ensure you have enough money to cover your expenses. They can also prevent cash-flow problems that can derail your business – even if you're turning a profit.

You can also use your budget to evaluate whether you're achieving your goals. If you're falling short of your predicted earnings, then you can take decisive action to get your business back on track.

For example, you might reduce your planned expenditure or re-evaluate your marketing tactics to improve your conversion rates:

Moreover, if you're seeking investment for your online business, then a well-thought-out budget can attract potential backers. It can also help you answer tough questions, such as whether you can afford to hire more staff.

How to Create a Budget for Your Online Business (In 3 Steps)

While it may be tempting to spend a lot to grow your company quickly, it's essential to be realistic. If you overspend, your dream of running an online business can quickly turn into a financial nightmare. Here's how to set yourself up for long-term success with a budget.

Step 1: Identify Your Expenses

Most online businesses have fixed costs, such as your web hosting fees or software subscriptions. Since these expenses are predetermined, they're great starting points for your budget.

Fixed costs are essential for keeping your company running. For example, if you cannot pay your hosting provider, then they may suspend your account. If this were to happen, you essentially no longer have an online business.

When calculating these costs, it helps to have a record of your expenses, such as your bank statements. Then, identify all of the fees that remain constant each month:

You can now add up all of these expenses to get the total fixed cost of running your online business. This is the bare minimum you need to keep your company alive.

Variable costs are a bit more complicated. They change relative to how much your company sells or produces. As such, they can vary depending on the services or goods your online business requires to operate within a given timeframe.

When calculating your variable costs, it helps to clarify how you want to measure your services. For example, you might quantify them based on the hours you put into your work. You can then associate the relevant costs with each unit produced, such as the hours spent at your computer.

Finally, it's time to consider your one-time costs. These expenses are particularly relevant in the early stages of your startup. For example, you might purchase a domain name or furniture for your home office.

Step 2: Forecast Your Revenue

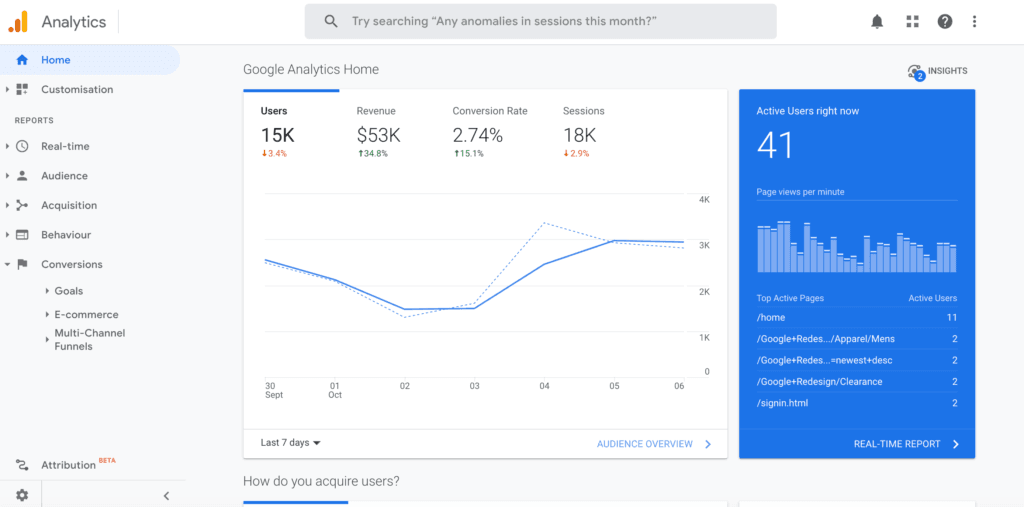

Once your online business starts making money, you can use this activity to forecast your future revenue. You can also use your previous conversions to estimate your expected income in the following days, weeks, months, or even years.

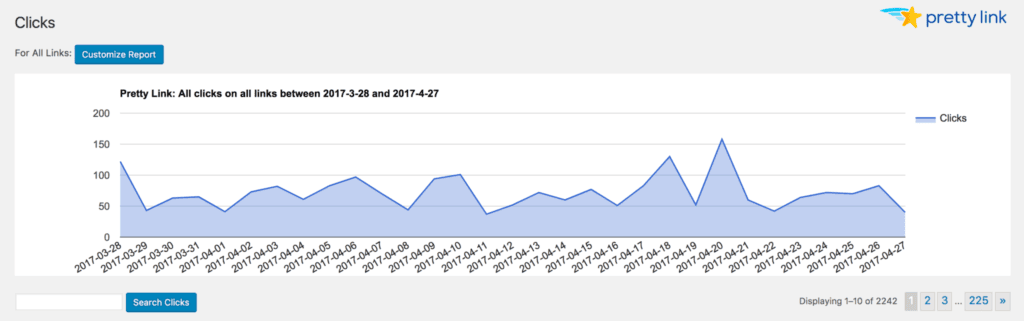

To make this process easier, many modern tools feature built-in tracking and analytics. For example, Pretty Links enables you to monitor how people are interacting with your affiliate links:

By predicting your revenue, you can evaluate whether you're on track. You can also decide if it's time to change your approach.

It's important to remember that you can create a more effective budget with accurate projections. For this reason, you'll want to continuously compare your actual income and projected revenue. Then, you can make adjustments to ensure your data is accurate as possible.

If you're a new business, then you may have limited data. Your sales may also be unpredictable as you build an established customer base. Here, it may help to identify competitors who target a similar audience and have comparable pricing for their products and services. You can then look for information about a company's finances, such as its total sales or annual revenue report.

Step 3: Track Your Net Profit Margin

If you're generating revenue, then you're off to a good start. However, just because you're making money doesn't necessarily mean you're turning a profit.

The net profit margin is an essential metric for measuring your success. It refers to the funds remaining after you deduct all of your running costs and taxes. By closely monitoring your net profit margin, you can avoid running your business at a loss.

To calculate your net profit margin, add up all of your earnings and expenses. Then, simply subtract your expenses from your earnings. If you end up with a negative number, then you're losing money.

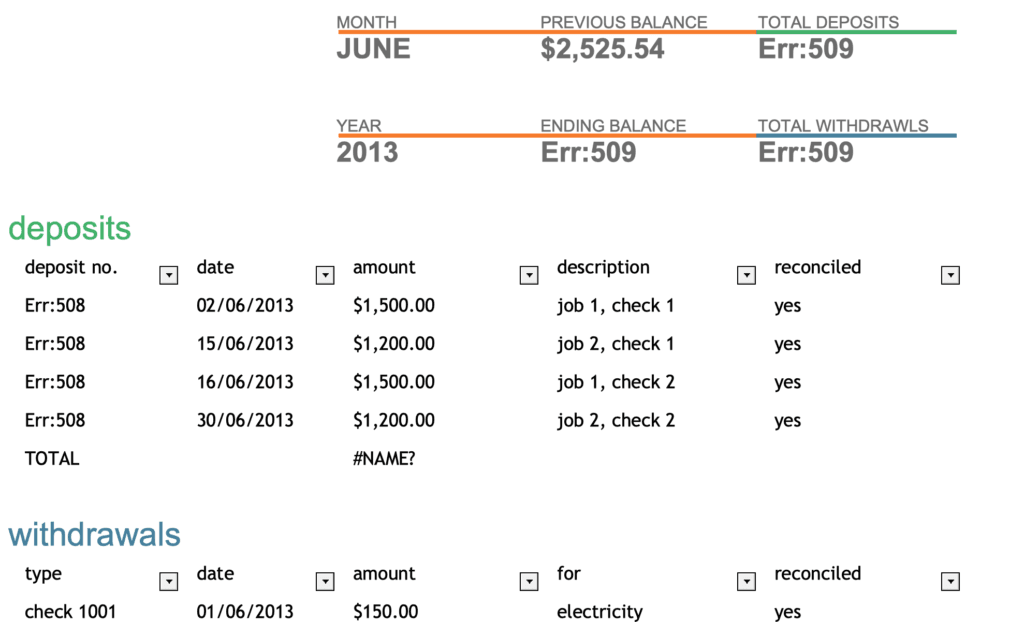

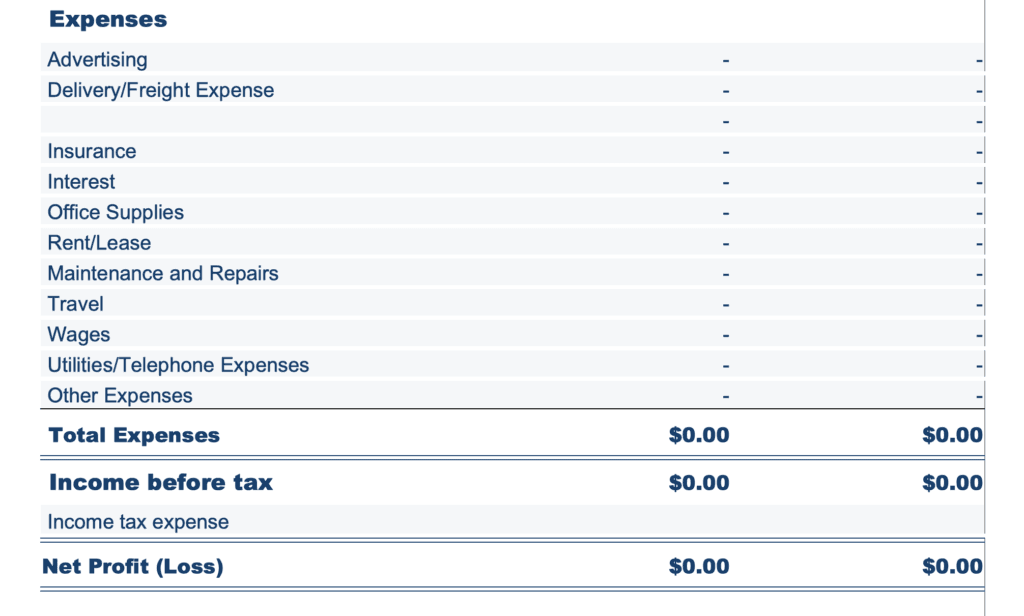

Since net profit margin is such an important metric, you may want to track it separately in a Profit and Loss Statement. This financial document summarizes your revenue, costs, and expenses during a set period:

When budgeting, it's easy to get distracted by your total number of sales. A Profit and Loss Statement makes it easy to check whether your online business is thriving or if it's time to make some changes.

Conclusion

If you want your online business to succeed, it's important to know where you are and where you're heading. A well-researched budget can be your blueprint for building a successful and profitable company.

Let's quickly recap how to create a budget for your online business:

- Identify your expenses.

- Forecast your revenue.

- Track your net profit margin.

Do you have any questions about making a budget for your online business? Let us know in the comments section below!

If you liked this article, be sure to follow us on Facebook, Twitter, Pinterest, and LinkedIn! And don't forget to subscribe to our newsletter!